how to pay taxes on betterment

The advertised number represents the pretax amount youd get if you were to receive. Box 9711 Boston MA 02114 You.

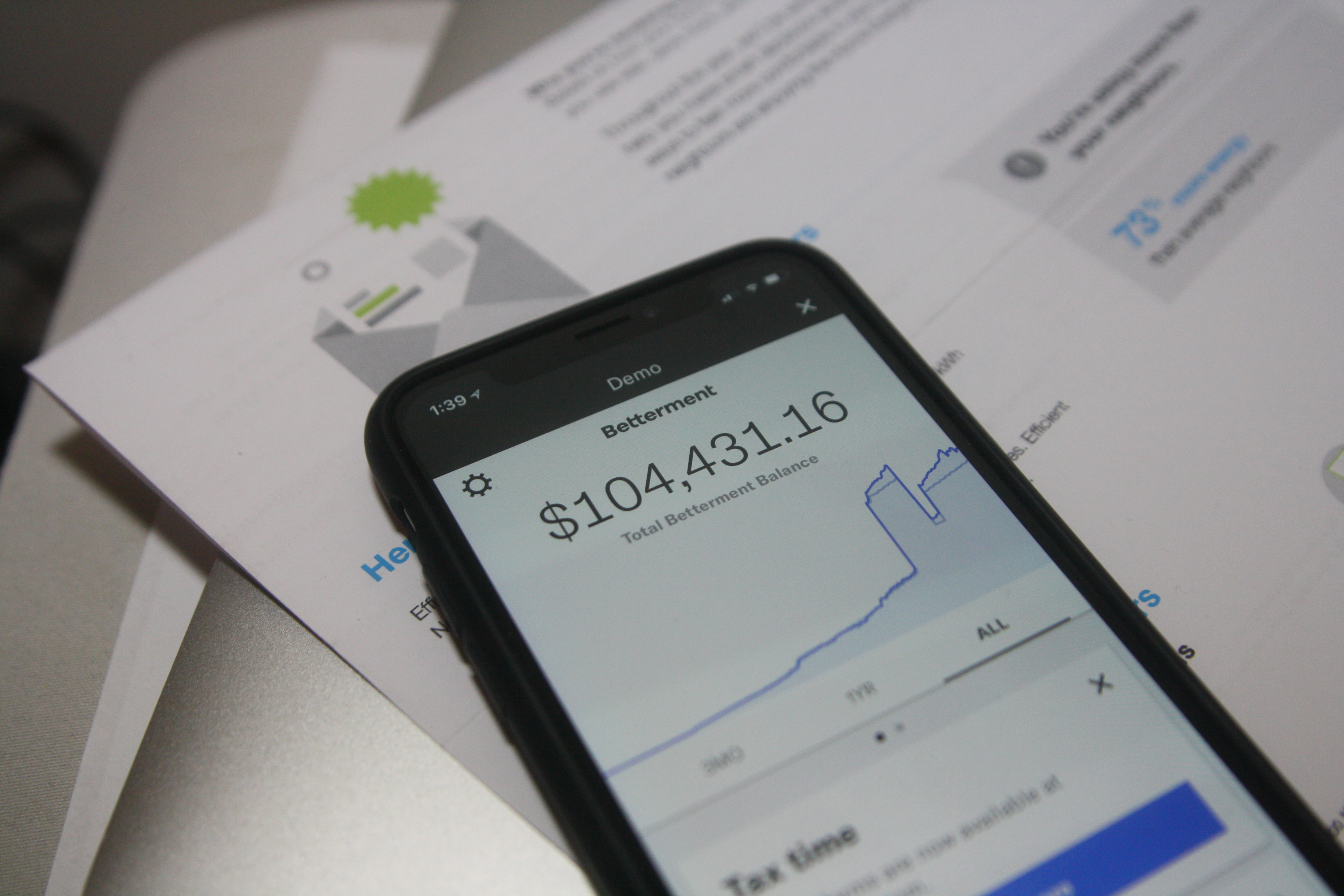

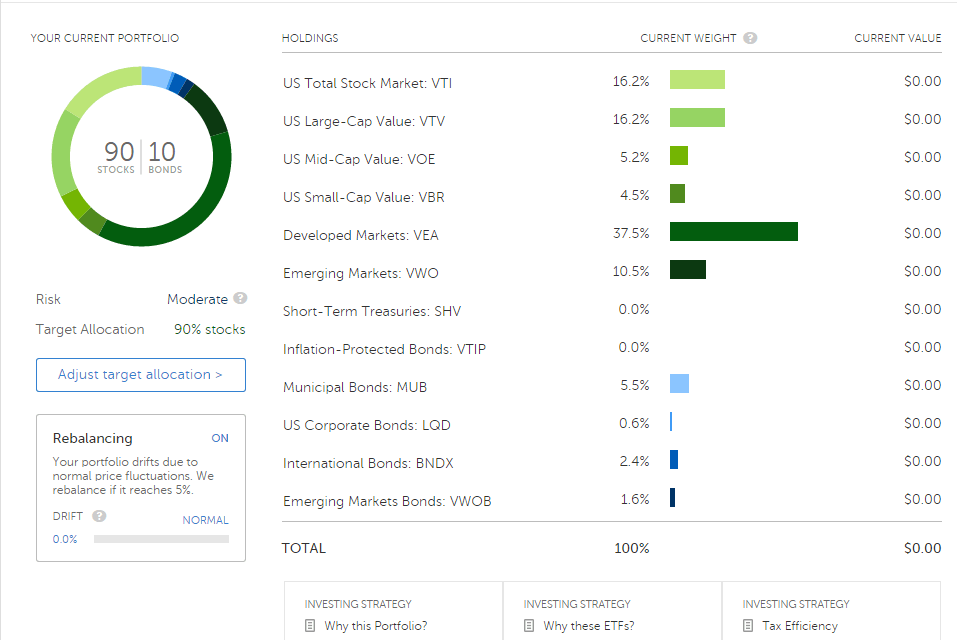

Betterment Investing Review Make Investing Automatic

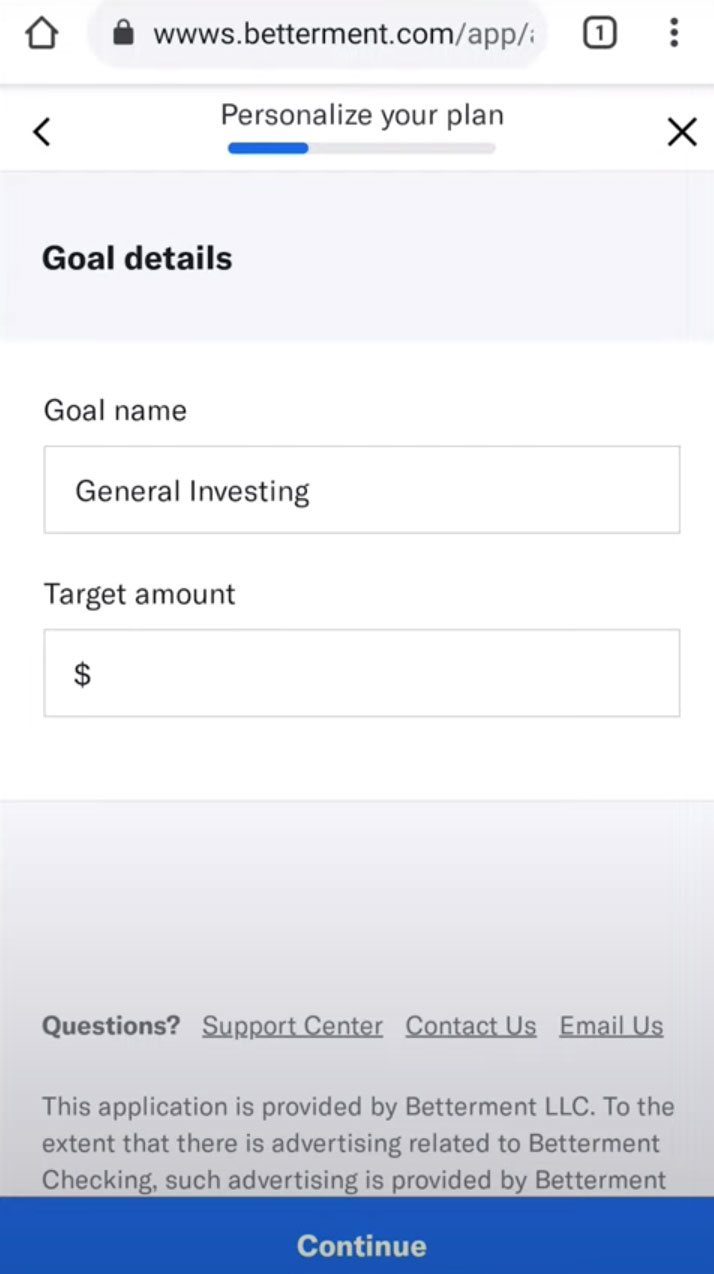

Go to Your Account Pay from Your Bank Account For individuals only.

. Credit or debit cards. City of Boston Office of the Collector-Treasurer PO. Special Property Tax A.

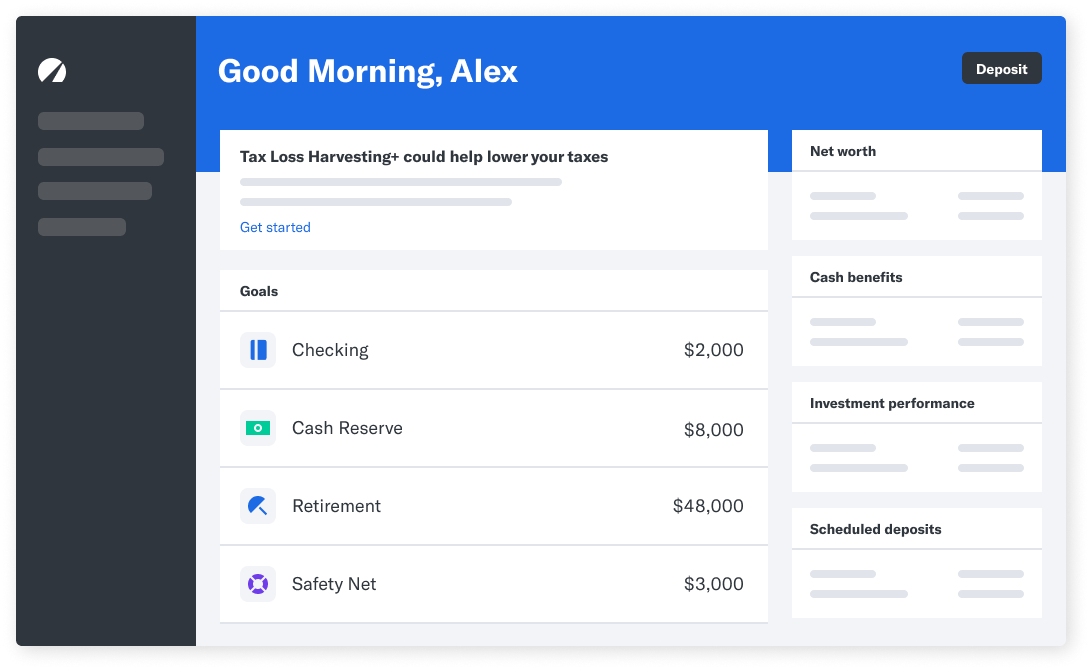

Read more from the IRS on Roth. The 1099-DIV reflects dividend payments received and capital gains distributions from stocks you own. Otherwise a homeowner pays off the betterment loan over time as an additional line item on their property tax bill.

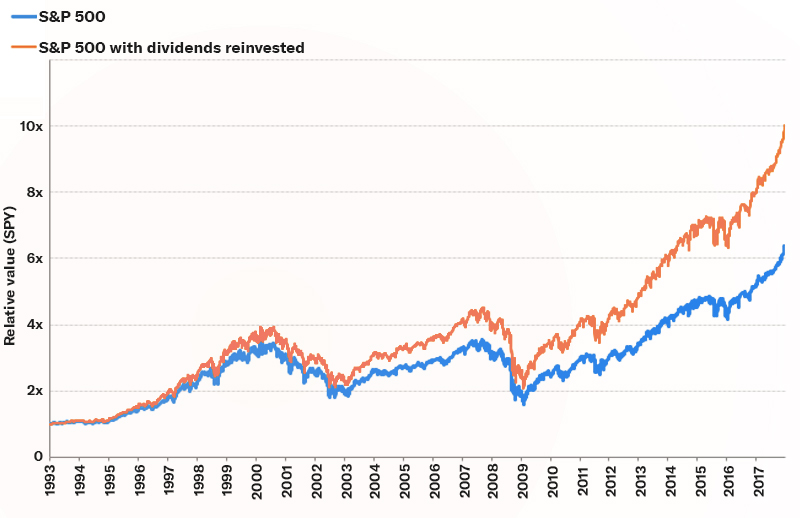

Dividends will always be taxed so you need to break down your profit into dividends realized and unrealized gains. Schedule payments up to a year in advance. Do you have to pay taxes on betterment.

Pay directly from a checking or savings account for free. Betterment will send you. So how do you pay 0 taxes when you make six figures.

You can mail payments by check or money order made payable to the City of Boston. Only dividends and realized gains will have tax due. Are also adopting this practice even in places that dont require.

You can pay your taxes online or by phone on the IRS own system. Heres how payments break down for Medicare Part B full coverage in 2023. 16490 in 2023 a decrease of 520 from 17010 in 2022.

Usually there is no penalty for an early payoff of a betterment loan. Pay your taxes by debit or. You pay yourself 60000 a year as a salary and pay the 153 self-employment tax of.

As New York City joins localities requiring employers to publish pay ranges in job ads more employers across the US. Depending on the size of your refund you may want to resubmit your Form W-4 to your employer to adjust the amount of taxes withheld from each future paycheck. Any dividends you receive are automatically reinvested by Betterment grow tax-free and are also withdrawn tax-free.

Pay your taxes by debit or credit card online by phone or with a mobile device. You will receive one by Feb. The jackpot for Powerballs Monday night drawing is a whopping 1 billion.

While you cannot deduct betterment taxes from your income when you file your federal income. No fees from IRS. 15 2022 if you had a Betterment taxable account and.

Tax Impact Using Our Cost Basis Accounting Method

Owning Vti At Both Vanguard And Betterment Jordan Burnett

Four Ways Betterment Can Help Limit The Tax Impact Of Your Investments

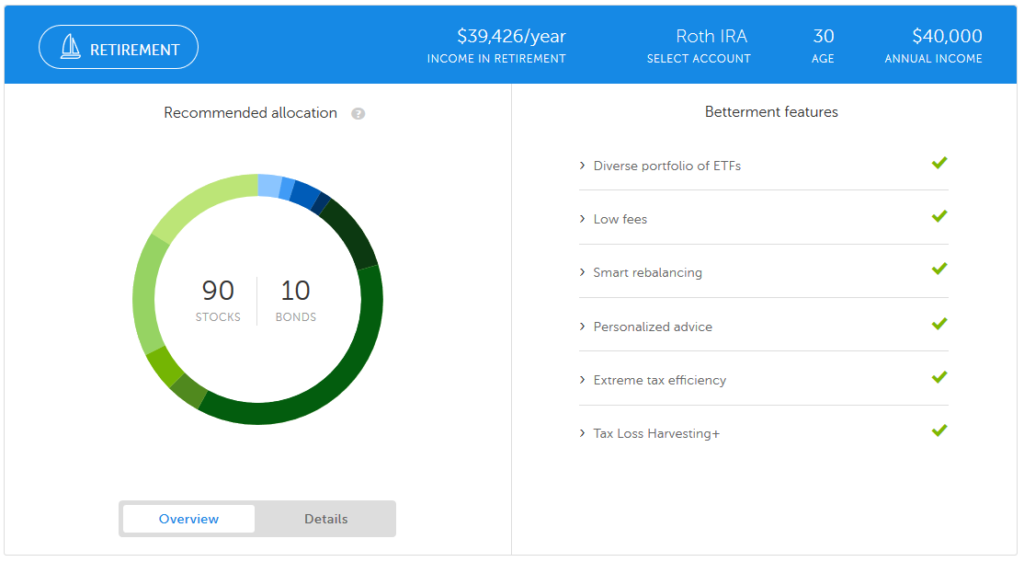

How To Manage Your Income In Retirement Betterment

Betterment Review 2022 Pros Cons And How It Compares Nerdwallet

Tax Smart Investing With Betterment

Betterment Vs Wealthfront Vs Acorns Which Robo Advisor Wins In 2022

Betterment Review Smartasset Com

Betterment Review 2022 How It Works Pros And Cons And My Honest Opinion

Betterment Review A Better Investment Method

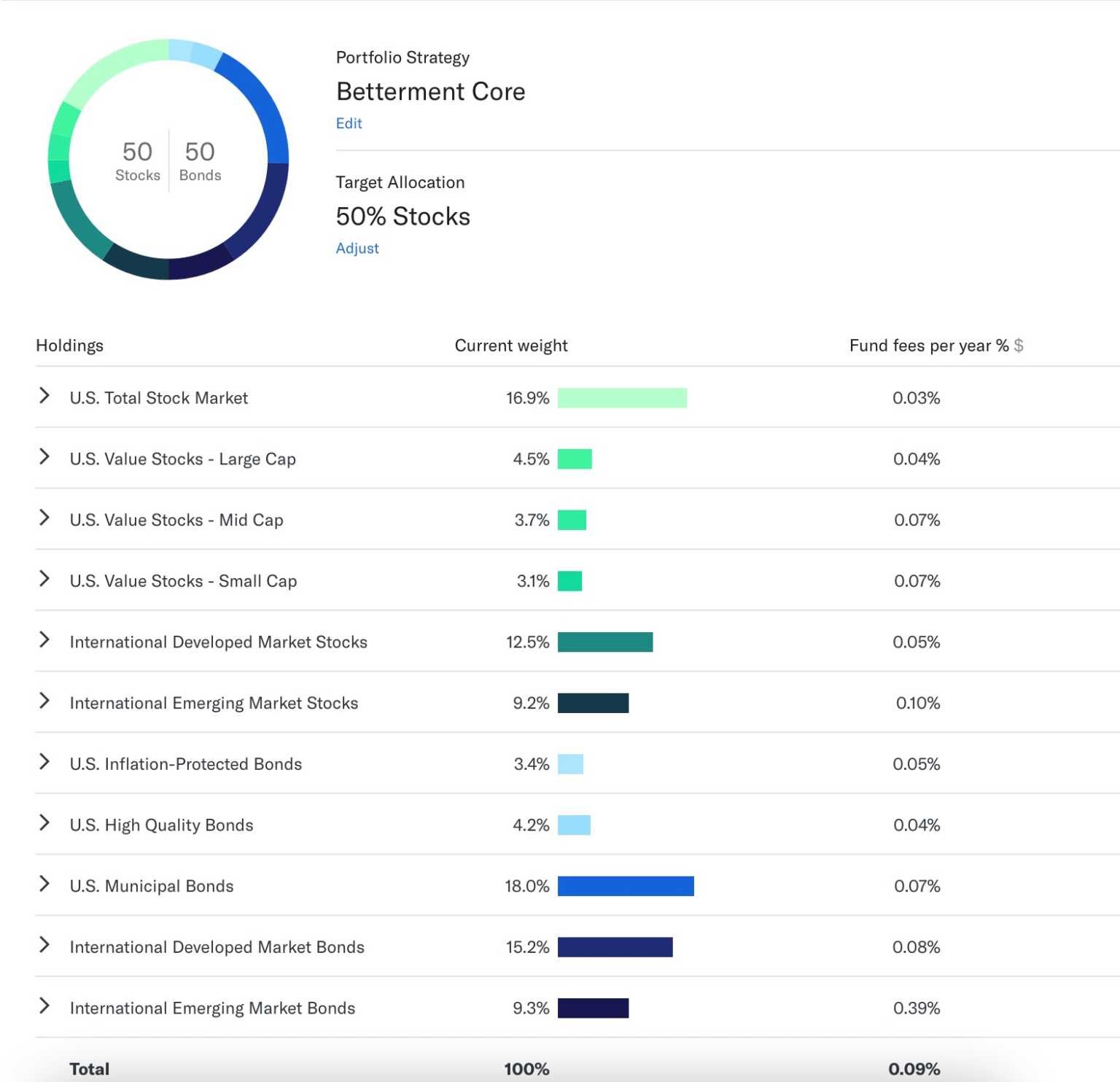

Betterment Investing Robo Advisor 2022 Review Should You Use It Mybanktracker

Betterment Review A Better Investment Method

Tax Loss Harvesting Methodology

Betterment Answers Your Tax Season Questions From 401 K S To Hsas

Betterment Tax Loss Harvesting Review What You Should Know About The Betterment Tax Program Advisoryhq

Better Investing With Betterment

Betterment Review 2022 Pros Cons And How It Compares Nerdwallet

Betterment Cranks Up Features And Costs Is It Still Worthwhile Mr Money Mustache